Importance Of Correlation In Business Decision Making Process

The importance of correlation in business decision making shows up in two main ways. First, people overweight factors. Second, they underweight them. Both lead to poor decisions.

Four Examples Of Common Correlations In Business

This occurs because people frequently treat a correlation as a cause. For example here are four common business correlations:

- Doing a good job correlates with getting a pay raise.

- Hiring a good sales person correlates with seeing more sales.

- The conscientious personality type correlates with fewer process errors.

- Spending more on research correlates with more innovation.

Yet, in each case, one does not automatically cause the other. Other factors come into play. Some we know. Some we don’t. So, simply, the importance of correlation in business decision making processes means better weighing of these factors.

As a contrasting example, take a manufacturing process. It generally accounts for all factors. Few unknown ones exist. That’s how it can produce the same product over and over again. Little variation occurs. In other words, doing X, Y and Z to A, B and C cause a specific outcome again and again.

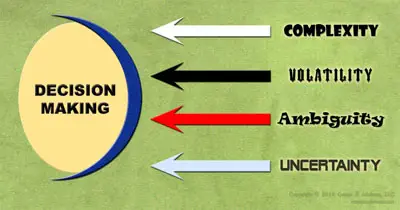

A key importance of correlation in business decision making is its help in tackling complexity, volatility, ambiguity and uncertainty that normally come with problems.

Importance Of Correlation In Business Decision Making

The four examples above are quite different from a manufacturing process. There are many unknowns. Many aren’t controllable too. As a result, each example yields a range of outcomes as opposed to a single, specific one.

In many ways then, a decision making process is making use of correlation, if it accounts for unknown or difficult factors that show up as uncertainty, volatility, complexity and ambiguity. These four can wreak havoc on any decision. This does not mean it has to identify the factors causing this. It just means it accounts for them.

How Correlation Affects Business Decisions

In summary then, the key importance of correlation in business decision making processes is that it protects us from uncertainty, volatility, complexity and ambiguity. It does this by compelling the process to account for these four by means such as these:

- Holding resources in reserve and taking small steps against uncertainty

- Avoiding instant decisions until volatility shows a more definite trend

- Simplifying complexity or finding those who can handle it well

- Allowing for flexible responses as ambiguity becomes clearer

In short, seen in this way then, correlation in business decision making processes protects us from what we don’t know. Along with probability then, they ensure that we make decisions that properly account for the risk at hand.