America’s Faith-based Economy

When I read articles like “Toss a Coin” (The Economist, January 12, 2013 edition), I’m reminded that our economy relies on faith. After all, as the article indicates, the U.S. Treasury prints money to satisfy its debts.

When I read articles like “Toss a Coin” (The Economist, January 12, 2013 edition), I’m reminded that our economy relies on faith. After all, as the article indicates, the U.S. Treasury prints money to satisfy its debts.

Of course, it prints purposefully to avoid the extremes of inflation and contraction. If the Treasury did not print money, our economy would slowly stop as our population expanded. It’s analogous to adding more oil to an ever-growing car engine so it won’t lock up.

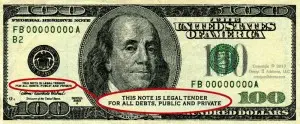

However, the money is simply paper. Nothing tangible supports it. For instance, we can’t exchange dollars for gold. Only the U.S. Government supports it (“This note is legal tender for all debts, public and private”), and our faith supports the government. Since this seems so certain, it’s tough to see this as faith until we experience its loss.

For me, this occurred in the last two weeks of 1989 when visiting Poland for familial reasons. The Communists were transferring power to a democratic government on New Year’s Day. In those two weeks, the Polish zloty went from 3,000/U.S. dollar to 10,000. Knowing we were Americans, cab drivers began demanding payment in U.S. dollars; faith had vanished.

The importance of this prompts the question: How can we apply rationale to something rooted in faith? Do we rationalize religion? This is why neoclassical economics faces the challenge from behavioral economics. It incorporates emotions of which faith is a form. It means business is uniquely human not objective. It’s faith in each other with the U.S. Government (“We the People”) merely a conduit for that faith. Consequently, this dual anchor of people and faith makes business . . . well . . . personal.

What happens when we lose faith in each other?